Creating money calls for both diligent investing and careful financial planning. Mutual fund investing is among the best strategies for realizing steady financial progress. Whether your level of experience with investing is low or high, mutual funds provide a straightforward and diverse approach to increasing your wealth over time. Options, including debt funds, index funds, and ELSS mutual funds, let you design a well-balanced portfolio fit for your financial objectives.

- The Authority of Mutual Funds

Combining money from many investors, mutual funds invest in mutual funds diversified assets like stocks, bonds, and commodities. While providing growth possibilities, this diversification lowers risk. Unlike stock trading, in which ordinary investors have to actively follow market patterns and price swings, mutual funds are run by professional fund managers making smart investment decisions.

For individuals who trade frequently in equities and derivatives, knowing the option chain is absolutely vital. Long-term investors, however, who give wealth development top priority over daily market swings find mutual funds more practical and less taxing. Mutual funds help you to avoid the complexity of investing individual equities and yet profit from market development.

- Why would one want to invest in mutual fund?

Making long-term mutual fund investments offers many benefits. Compounding guarantees that over time your investments increase tremendously. Consistent, even modest investments can lead to significant wealth building. Furthermore flexible are mutual funds, which let investors select among several fund kinds depending on their financial objectives and risk tolerance.

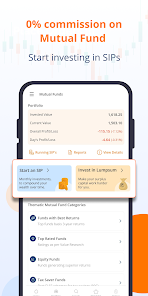

For novices, a trading software streamlines the investment procedure. Modern trading apps give investors easy access to mutual funds so they may monitor their portfolio, examine returns, and make wise decisions. Unlike conventional investment strategies, a trading app provides real-time data, fund comparisons, and automated investment possibilities, thereby facilitating long-term commitment.

- ELSS Mutual Fund Tax Advantages

ELSS mutual funds—equity-linked savings schemes—are a great choice if you are seeking tax-saving investment possibilities. These monies provide market-linked returns together with tax deductions under Section 80C of the Income Tax Act. ELSS mutual funds promote disciplined long-term investing with a required three-year lock-in period, therefore guaranteeing that you remain invested even through market swings.

ELSS mutual funds offer better return potential than conventional tax-saving devices including fixed deposits and PPF. For those trying to mix tax savings with wealth creation, their equity exposure lets investors profit from stock market gains.

- How One Should Get Started?

Start your mutual fund investment process by determining your risk tolerance and financial objectives. Depending on your investing horizon, decide which of equity, debt, hybrid, or ELSS mutual funds best fit you. You can quickly evaluate several funds, review their past performance, and automatically monthly invest using SIPs (Systematic Investment Plans) by means of a trading app.

Balancing short-term trading with long-term mutual fund investments can offer the best of both worlds for active traders that know market movements and the option chain. While mutual funds guarantee consistent growth over time, trading presents instant profit prospects; so, a well-rounded financial plan is created.

Conclusion:

Investing in mutual funds is a wise approach toward long-term financial stability regardless of your level of experience with investing. Professional fund management, diversification, and compounding returns combine to make mutual funds the best option for wealth building. Using a trading app, tracking the option chain for market insights, and investigating tax-saving possibilities via ELSS mutual funds will help you create a robust investment portfolio that guarantees your future.