Modern investing has become more accessible due to digital platforms and structured financial products. Among these options, popular mutual funds have emerged as a preferred choice for individuals seeking long-term financial planning without the need for constant market tracking. These funds allow investors to participate in equity and debt markets through professionally managed portfolios. Before beginning this journey, many investors choose to create a demat account, which helps in holding investments digitally and tracking them with ease.

Popular mutual funds appeal to both beginners and experienced investors because they offer diversification, transparency, and flexibility. Instead of selecting individual securities, investors gain exposure to a broader range of assets through a single investment. As financial awareness grows, popular mutual funds continue to simplify modern investing by aligning structured planning with individual financial goals.

Understanding the Concept of Popular Mutual Funds

Popular mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified set of assets. These assets may include equities, fixed-income instruments, or a combination of both. The popularity of these funds often stems from their consistent performance, clear objectives, and suitability for different investor profiles.

Investors who create a demat account can easily monitor their holdings and make informed decisions. Popular mutual funds are structured to suit various financial timelines, making them adaptable to short-term and long-term objectives. This structure reduces the complexity traditionally associated with market participation.

Why Popular Mutual Funds Are Gaining Investor Attention

Accessibility for Modern Investors

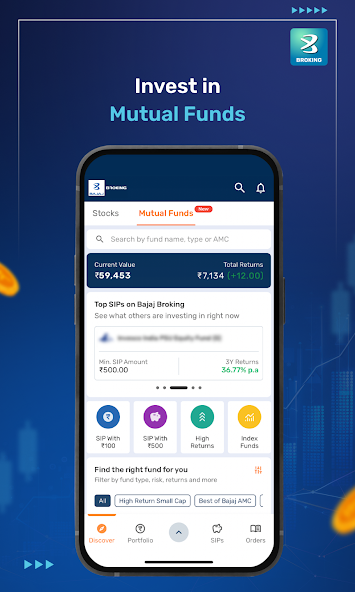

One of the primary reasons behind the rising interest in popular mutual funds is accessibility. Investors can begin with relatively small amounts and increase contributions gradually. Digital access further enhances convenience, allowing individuals to invest after they create a demat account and complete basic formalities.

Professional Portfolio Management

Popular mutual funds are managed by experienced professionals who analyze market conditions, asset performance, and economic trends. This professional oversight reduces the burden on individual investors who may not have the time or expertise to manage investments independently.

Transparency and Regulatory Oversight

These funds operate under defined regulations, offering clarity regarding asset allocation, risk levels, and expenses. Investors receive regular updates that help them understand how their money is being managed.

Types of Popular Mutual Funds Based on Investment Objectives

Equity-Oriented Mutual Funds

Equity-based popular mutual funds focus on investing primarily in shares of companies. These funds aim for capital appreciation over time and are often chosen by investors with a higher risk tolerance and longer investment horizon.

Debt-Oriented Mutual Funds

Debt-focused popular mutual funds invest in fixed-income instruments such as bonds and securities. These funds are generally preferred by investors seeking stability and predictable returns.

Hybrid Mutual Funds

Hybrid popular mutual funds combine equity and debt investments within a single portfolio. This balance helps manage risk while still offering growth opportunities, making them suitable for moderate-risk investors.

How Popular Mutual Funds Support Financial Goals

Goal-Based Investment Planning

Popular mutual funds allow investors to align their investments with specific goals such as education planning, retirement preparation, or wealth accumulation. By selecting funds based on time horizon and risk appetite, investors can structure a disciplined approach to investing.

Long-Term Wealth Creation

Consistent investing in popular mutual funds over extended periods may support gradual wealth creation. Compounding plays a key role in this process, rewarding patience and consistency rather than frequent trading.

Risk Distribution Through Diversification

Diversification is a key advantage of popular mutual funds. By spreading investments across multiple sectors and instruments, these funds reduce dependency on a single asset, which helps manage overall portfolio risk.

Steps to Begin Investing in Popular Mutual Funds

Step 1: Create a Demat Account

To start investing, individuals typically need to create a demat account. This account allows investors to hold mutual fund units and other securities electronically, reducing paperwork and improving tracking efficiency.

Step 2: Define Investment Objectives

Before selecting popular mutual funds, investors should clearly identify their financial goals, investment horizon, and risk tolerance. This clarity ensures better fund selection and long-term discipline.

Step 3: Choose Suitable Mutual Fund Categories

Based on goals and risk profile, investors can select from equity, debt, or hybrid popular mutual funds. Understanding fund objectives and asset allocation is essential before investing.

Step 4: Monitor and Review Periodically

Although popular mutual funds are professionally managed, periodic reviews help ensure alignment with changing financial goals. Investors who create a demat account can easily access performance updates and portfolio details.

Role of Discipline in Mutual Fund Investing

Discipline plays an important role in achieving desired outcomes through popular mutual funds. Regular contributions, patience during market fluctuations, and long-term commitment are essential aspects of a structured investment approach.

Investors often benefit from staying invested during market cycles rather than reacting to short-term movements. Popular mutual funds are designed to withstand market variations over time, offering stability through diversification.

Common Considerations Before Investing

Understanding Risk Levels

Every investment carries some degree of risk. Investors should understand that popular mutual funds vary in risk depending on asset composition and market exposure.

Expense Awareness

Although mutual funds involve management costs, understanding expense structures helps investors make informed decisions. Transparent disclosures allow for better evaluation of long-term impact.

Investment Horizon Alignment

Matching fund selection with investment duration is critical. Short-term goals may require conservative options, while long-term goals can accommodate higher exposure to growth-oriented funds.

Conclusion

Popular mutual funds continue to simplify modern investing by offering structured, diversified, and goal-oriented investment solutions. They reduce the complexity of market participation while allowing investors to benefit from professional management and regulatory transparency. For individuals beginning their investment journey, choosing to create a demat account is often the first step toward accessing these funds efficiently.

As financial awareness increases, popular mutual funds remain relevant for investors seeking consistency and clarity in their investment approach. By aligning disciplined strategies with long-term objectives, these funds help investors navigate modern financial markets with confidence and purpose.