Navigating the world of investments starts with a demat account, a fundamental tool for storing and managing securities digitally. It’s your gateway to participating in the financial markets without the hassle of handling physical share certificates. Today, you can open a free demat account with no hidden fees, offering a cost-effective solution for beginners and seasoned investors alike. By choosing a top-tier demat account and leveraging an efficient Share Market App, you can streamline your trading experience and unlock growth opportunities in the market.

This article dives into the benefits of a free demat account, how to open one, and what features to prioritize to ensure a smooth and secure investing journey.

Understanding a Demat Account

A dematerialized account, commonly referred to as a demat account, stores your financial instruments such as equities, bonds, mutual funds, and government securities in an electronic format. This eliminates the need for paper-based certificates, ensuring safety, convenience, and easy accessibility.

To execute trades in the share market, you’ll need both a demat account to hold securities and a trading account to buy or sell them. With advancements in financial technology, integrating these accounts with investment apps has made trading more efficient and accessible to everyone.

Major Advantages of a Free Demat Account

- Cost Efficiency: A free demat account eliminates account opening fees, allowing you to start your investment journey without additional financial burden.

- Simplified Investment Management: Consolidate all your holdings, including shares, mutual funds, and ETFs, in one place for effortless portfolio monitoring.

- Enhanced Security: Digital storage protects your securities from theft, loss, or damage associated with physical certificates.

- Real-Time Access: By linking your demat account to a reliable investment app, you gain real-time insights into market performance and your portfolio’s status.

- Diverse Investment Options: From stocks to bonds and exchange-traded funds, a demat account accommodates a variety of investment instruments, broadening your financial horizons.

Opening a Free Demat Account: A Stepwise Approach

1. Research Your Options

Look for providers offering free demat accounts without hidden costs. Compare their features, customer support quality, and user reviews to identify the best option for your needs.

2. Fill Out the Application Form

Visit the provider’s website or download their app to initiate the account opening process. You’ll need to provide basic personal details, including your name, contact information, and bank account details.

3. Submit Required Documents

To complete the Know Your Customer (KYC) process, submit the following:

- A government-issued ID like PAN or Aadhaar card.

- Proof of address, such as a utility bill or voter ID.

- A canceled cheque or bank statement for financial verification.

4. Complete Verification

Most providers offer a seamless online verification process. Once your details are verified, your demat account will be activated, often within a few hours.

5. Start Investing

Link your demat account with a trading platform or investment app to begin buying and selling securities. These platforms offer advanced tools for tracking market trends and executing trades efficiently.

The Best Demat Accounts: Key Features Explained

When selecting a demat account, ensure it includes the following features:

- Transparent Pricing: Avoid platforms with hidden fees and focus on those offering clear and upfront cost structures.

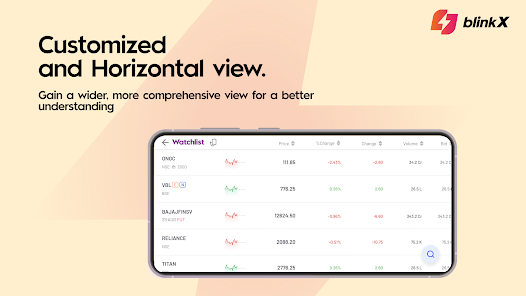

- User-Friendly Platform: A well-designed interface ensures smooth navigation, especially when accessed through an investment app.

- Efficient Transactions: Choose a provider known for quick and hassle-free processing of transactions.

- Data Security: Ensure that the platform employs robust encryption and security measures to safeguard your financial data.

- Comprehensive Investment Options: Opt for an account that supports a diverse range of instruments, from stocks to mutual funds and ETFs.

How an Investment App Complements Your Demat Account

Investment apps have revolutionized the trading experience by providing:

- Ease of Access: Manage your investments anytime, anywhere with a few taps on your smartphone.

- Real-Time Market Updates: Stay informed about stock price movements, indices, and global trends.

- Portfolio Tracking: Monitor your investments in real-time to assess performance and make informed decisions.

- Instant Notifications: Receive alerts for price changes, news updates, and trading opportunities.

Using a demat account in tandem with an investment app enhances your ability to seize market opportunities and streamline your trading activities.

Points to Consider Before Opening a Free Demat Account

While the concept of a free demat account is attractive, it’s essential to evaluate:

- Annual Maintenance Fees: Some accounts charge annual maintenance fees even if they waive opening charges. Check the details beforehand.

- Transaction Costs: Confirm whether the platform imposes fees for buying, selling, or transferring securities.

- Account Features: Assess the platform’s tools and features to ensure they align with your investment goals.

- Customer Support: Responsive and helpful customer service is critical for resolving issues promptly.

- Regulatory Compliance: Verify that the provider follows legal and regulatory standards to ensure transparency and security.

Conclusion

A free demat account with zero hidden charges is the perfect starting point for anyone entering the financial markets. By combining it with a robust investment app and prioritizing features like transparency, security, and convenience, you can create a seamless and rewarding trading experience. Take time to research and select a top demat account provider that aligns with your financial objectives.

With the right approach, your demat account becomes more than a tool—it’s a gateway to exploring the vast potential of the investment world. Start your journey today and unlock endless opportunities in the share market with confidence and ease.