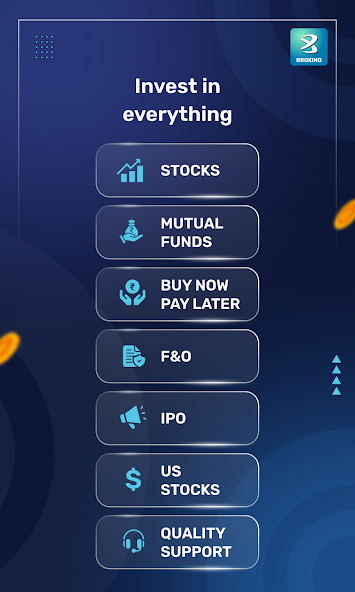

Digital lending has become a common way for individuals to manage short-term financial needs. An Indian Loan app provides access to funds without long paperwork or branch visits, allowing users to apply, verify details, and track repayments through a mobile device. For many people, this method has simplified the borrowing process, especially during urgent situations. A pay later loan app also offers flexibility for small purchases and short repayment cycles, making it useful for planned and unplanned expenses.

Understanding how an Indian Loan app works helps borrowers make informed decisions and avoid unnecessary costs. While digital platforms can make borrowing easier, users should review terms, repayment timelines, and charges carefully. This explains the essential features, eligibility factors, safety checks, and repayment practices related to loan apps in India.

Understanding the Role of an Indian Loan App

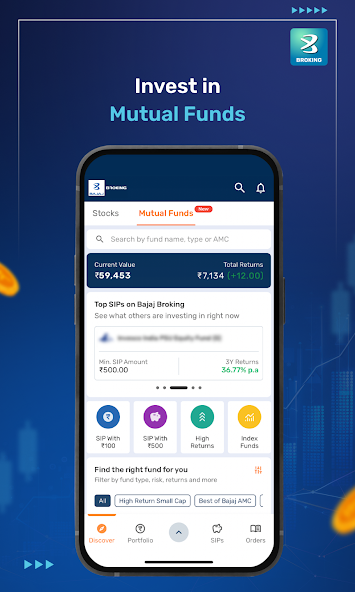

An Indian Loan app is a mobile platform that allows individuals to apply for short-term or medium-term credit using digital verification. Most applications require basic personal details, income information, and bank account data to process a request. Once verified, the loan amount may be credited directly to the user’s account.

These apps often serve individuals who need smaller loan amounts for immediate expenses such as medical bills, travel, or utility payments. The convenience of applying at any time has made them widely used. However, borrowers must review repayment schedules, interest rates, and service charges before accepting an offer.

A pay later loan app works in a similar manner but is often used for smaller purchases or short-term credit cycles. Instead of paying upfront, users can make purchases and repay within a fixed period. This option can help manage monthly budgets when used responsibly.

Key Features to Review Before Applying

Application Process and Approval Time

Most loan apps provide a simple application process that involves filling in personal details and uploading required documents. Approval times can vary depending on the verification process. Some apps offer same-day approvals, while others may take longer for review.

Loan Amount and Tenure

An Indian Loan app usually offers different loan ranges depending on eligibility. Some users may qualify for smaller amounts initially, with higher limits available after consistent repayment. The tenure may range from a few weeks to several months.

Charges and Interest Structure

Before accepting a loan, users should review the interest rate and additional charges. Some apps include processing fees, late payment charges, and service fees. Understanding the total repayment amount helps avoid confusion later.

Repayment Options

Most apps allow repayment through bank transfer, debit card, or automated deductions. A pay later loan app often provides shorter repayment cycles, so users must ensure funds are available before the due date.

Eligibility and Verification Factors

Eligibility criteria for an Indian Loan app can vary, but most platforms require:

- A valid identification document

- A stable source of income

- An active bank account

- A mobile number linked to financial records

Verification is usually completed through digital methods such as document upload or bank account confirmation. Accurate information improves the chances of approval and prevents delays.

Benefits of Using a Digital Loan Platform

An Indian Loan app offers several advantages when used carefully:

- Convenience: Applications can be completed from home without visiting a branch.

- Speed: Many apps process requests quickly after verification.

- Flexible options: Users can choose loan amounts and tenures based on needs.

- Tracking tools: Borrowers can monitor due dates and payment history through the app.

A pay later loan app is useful for managing small expenses that need short-term credit support. It allows users to maintain cash flow while handling regular payments.

Points to Consider Before Borrowing

Check Terms Carefully

Users should read all conditions before accepting a loan. Reviewing interest rates, fees, and repayment schedules ensures clarity.

Borrow Only What Is Needed

Taking a larger loan than required may increase repayment pressure. Choosing an amount that fits the budget helps maintain financial balance.

Plan Repayments in Advance

Setting reminders or enabling automatic payments can prevent missed deadlines. Late payments may lead to additional charges and affect future eligibility.

Verify App Security

Before sharing personal information, ensure the app uses secure login methods and proper data protection practices. Checking permissions and privacy policies can reduce risks.

Managing Repayments Without Stress

Repayment planning is essential when using an Indian Loan app. Users should review monthly income and expenses to ensure they can meet due dates comfortably. Maintaining a simple repayment schedule helps track obligations.

A pay later loan app may require repayment within a short cycle, so timely payments are important. Keeping funds ready before the due date can prevent extra charges. Consistent repayment history may also improve eligibility for future loans.

Responsible Use of Loan Apps

Digital loan platforms can support short-term financial needs when used with care. Borrowers should avoid using multiple apps at the same time, as this may create repayment difficulties. Instead, they should focus on maintaining a manageable loan amount and clear repayment plan.

Maintaining financial discipline helps users benefit from an Indian Loan app without creating long-term debt. Reviewing monthly expenses, setting aside repayment funds, and avoiding unnecessary borrowing can improve financial stability.

Common Mistakes to Avoid

- Ignoring terms and conditions before accepting a loan

- Missing repayment deadlines

- Borrowing more than necessary

- Using multiple loan apps without planning

- Not checking total repayment cost

Avoiding these mistakes can help users manage digital loans more effectively and reduce financial stress.

Future of Digital Borrowing in India

The use of digital lending platforms continues to grow as more individuals rely on mobile solutions for financial support. An Indian Loan app is becoming a regular option for managing short-term expenses, and a pay later loan app provides flexibility for smaller purchases. As technology evolves, users can expect improved verification methods and clearer repayment tracking.

However, responsible borrowing will remain important. Understanding loan terms, planning repayments, and maintaining a balanced budget are key to using digital loan services effectively.

Conclusion

An Indian Loan app offers a practical way to access funds when managed carefully. By reviewing terms, selecting suitable loan amounts, and planning repayments, users can handle short-term financial needs without unnecessary pressure. A pay later loan app can also support small purchases when used within a clear repayment plan. Both options provide convenience, but responsible use ensures long-term financial stability. Choosing the right Indian Loan app and maintaining timely repayments can help borrowers meet their needs while staying in control of their finances.