Aiming to profit from short-term price swings, day trading is purchasing and selling stocks inside one trading day. It’s quite dangerous even if it might be quite profitable. Investment apps India can provide valuable tools and insights to help you navigate the stocks market and potentially improve your day trading strategies.

1. Select the appropriate program.

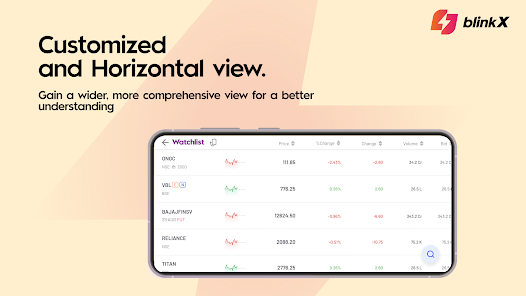

Choose a stock market app with day trading specific tools including real-time quotations, sophisticated charting tools, and market news. Think through elements including fees, dependability, and user interface. Search for an app that gives a flawless trading experience and a large spectrum of instructional tools to keep you current.

2. Grasp the fundamentals:

Learn basic ideas including market orders, limit orders, stop-loss orders, and technical analysis before starting day trading. Strong basis for making wise decisions and properly managing risk will come from a good knowledge of these fundamental ideas.

3. Work using a demo account.

Many investing applications let you practice trading with virtual money through free accounts. Without running actual money, this is a risk-free approach to test several tactics, boost confidence, and feel the market.

4. Keep Current:

Stay current with company announcements that might affect stock values as well as market news and economic data. Use the news feeds on your investment application and follow reliable financial news sources. Keep up with industry trends, geopolitical developments, and legislative changes likely to influence the stock market.

5: Create a trading strategy:

Investors may trade a range of financial instruments—including stocks, bonds, and derivatives on the stock exchange. Clearly state your objectives, risk tolerance, and trading approach including your methods. Follow your strategy and steer clear of emotional-driven, snap judgements. A well-considered trading plan will enable you to remain disciplined, properly control risk, and make logical judgements even under erratic market conditions.

6. Using technical analysis:

Studying past market movements and trends in technical analysis helps one find possible trade prospects. Examine trends, support levels, and resistance levels using the charting tools included by your investment app. Knowing technical indicators include moving averages, relative strength index (RSI), and Bollinger Bands helps you make better trading selections.

7. Handle Risk:

Day trading has inherent danger. Use risk-reducing strategies including stop-loss orders to control possible losses. Investing in a range of stocks helps you to diversify your portfolio and lower your risk to any one stock’s volatility. Think about applying position size and trailing stop-loss orders among the risk management features found on your investing app.

8. Learn and adjust constantly:

stocks market is ever changing and dynamic. Keep informed on the newest ideas and approaches. Learn constantly and modify your strategy to stay competitive in the quick-paced realm of day trading. Use the instructional tools provided by your investment software and engage in internet forums or communities to network with other traders and exchange expertise.

Conclusion:

Day trading calls both discipline, patience, and a readiness to let losses go. Approach it with a reasonable perspective and be ready for both successes and losses. Following these guidelines and using the tools and resources given by investment apps can help you improve your daily trading techniques and raise your chances of success.