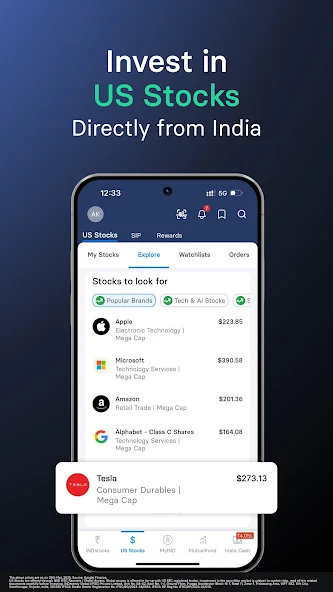

Investing in US markets is no longer limited to citizens of the United States. Global access to financial platforms has opened the doors for individuals worldwide to invest in stock and take advantage of one of the most robust financial systems in the world. Whether you’re a beginner or someone looking to diversify your portfolio, understanding the right entry points, strategies, and long-term approach is key to success.

In this you’ll discover practical steps to start investing in US markets with confidence, while focusing on informed decision-making and risk management.

Understanding the Basics of US Markets

Before diving into investment strategies, it’s essential to grasp how US markets function. The two primary exchanges are the New York Stock Exchange (NYSE) and the NASDAQ. These platforms host thousands of companies offering shares to the public. Investors purchase these shares to gain ownership stakes and potentially earn returns through price appreciation or dividends.

The US markets are segmented into different sectors including technology, healthcare, finance, industrials, and consumer goods. Studying these sectors helps identify areas of growth and stability for long-term investment.

Why Invest in US Markets?

There are several reasons investors are drawn to US markets:

- Stability and Regulation: The US financial system is among the most regulated globally, offering transparency and investor protection.

- Global Influence: Many companies listed on US exchanges have a global presence, giving investors exposure beyond the domestic economy.

- Diversification: Investing in US markets can help balance a portfolio that is overly dependent on local or regional assets.

Choosing to invest in stock from US-based companies allows investors to benefit from global economic growth and trends.

Step-by-Step Guide to Start Investing

1. Set Clear Investment Goals

Define what you want to achieve with your investments. Whether it’s long-term wealth creation, retirement planning, or saving for a specific goal, clarity will guide your decisions and risk appetite.

2. Choose the Right Investment Account

Depending on your location, you may need access to a platform that allows international investing. Ensure the account supports trading on US exchanges, provides required tax documents, and is compliant with your country’s regulations.

3. Learn About Different Asset Types

US markets offer a wide variety of investment vehicles:

- Individual Stocks: Direct ownership in a company’s shares.

- Exchange-Traded Funds (ETFs): Funds that track indices or sectors.

- REITs: Real estate investment trusts offering exposure to the property market.

Each asset type comes with varying levels of risk and return. It’s important to study their characteristics before you invest in stock or funds.

4. Start with Low-Risk Options

Beginners often benefit from starting with broad-market ETFs or index funds. These instruments track the overall performance of the market and help reduce the impact of short-term volatility.

Analyzing Stocks for Better Decisions

To successfully invest in US markets, learning how to analyze a company is critical. This can be done through two primary methods:

Fundamental Analysis

This involves studying a company’s financial health, revenue growth, profit margins, and debt levels. You should also consider external factors like industry trends and economic outlooks.

Technical Analysis

Focuses on historical price charts and trading volumes. While more advanced, it helps to understand patterns and signals that indicate potential price movements.

Common Mistakes to Avoid

Even experienced investors can make errors. Avoid these common pitfalls:

- Lack of Research: Never invest based on speculation or hearsay.

- Overtrading: Frequent buying and selling can lead to unnecessary losses and fees.

- Ignoring Diversification: Spreading investments across sectors reduces risk.

US markets can be highly liquid, which sometimes tempts investors into impulsive decisions. Patience and consistency are key virtues.

Stay Informed and Keep Learning

Staying updated with market news, financial reports, and economic indicators helps you make informed decisions. Following financial calendars and central bank policies can give insight into upcoming market movements.

Additionally, continuing education through books, podcasts, or credible financial websites enhances your ability to evaluate opportunities wisely.

Risk Management is Key

No investment is without risk. However, managing that risk is crucial to protect your capital. Some practical ways to manage risk include:

- Setting Stop-Loss Orders: Automatically sells a stock if it falls below a certain price.

- Asset Allocation: Spread investments across different asset classes like stocks, bonds, and cash.

- Rebalancing Your Portfolio: Adjust the proportion of assets regularly to maintain your investment goals.

By focusing on risk-adjusted returns, investors can navigate the US markets more effectively.

Use a Long-Term Approach

Short-term gains can be unpredictable. A long-term approach often provides better returns by allowing investments to grow through compounding. This also helps ride out market fluctuations and economic cycles.

Avoid panic during downturns. Instead, view them as opportunities to add quality investments at lower prices.

Conclusion:

Investing in US markets offers a gateway to participate in global growth, financial innovation, and economic leadership. With proper knowledge, planning, and discipline, anyone can begin their journey toward financial independence.

Make sure to define your goals, research thoroughly, manage risks, and take a long-term perspective. The decision to invest in stock across US markets can be a rewarding step toward building a strong financial future.

Remember, the journey of investing doesn’t require perfect timing, but rather consistent actions and informed choices. Start with small, thoughtful steps, and let the power of compounding and strategic planning guide your path.