Investing in Initial Public Offerings (IPOs) has always been a favored route for individuals seeking high-growth opportunities. With the increasing popularity of Ipo India, more investors are now looking for efficient ways to access these investment opportunities. One such solution is the IPO Investment App, a tool designed to streamline the process of investing in IPOs, offering simplicity, speed, and accuracy.

In this, we’ll explore how an IPO Investment App can help you maximize your portfolio, and why Ipo India present an appealing opportunity for investors.

What is an IPO Investment App?

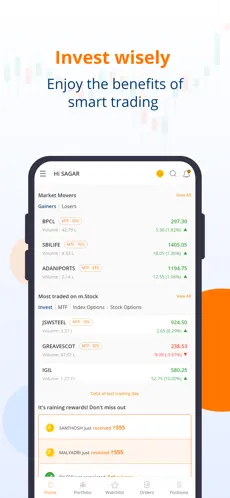

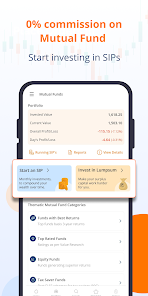

An IPO Investment App is a digital platform that allows investors to participate in the subscription of IPOs through their mobile devices. These apps are user-friendly and provide real-time updates on upcoming IPOs, application procedures, and allotment results. They typically offer a smooth process for applying to IPOs, making it easier for retail investors to gain access to these high-potential investments.

The rise of Ipo India has attracted significant interest from individual investors. The IPO market has been booming in recent years, thanks to the country’s expanding economy, strong business fundamentals, and growing stock market participation. This surge in demand for IPOs has fueled the development of IPO investment apps, allowing users to seize these opportunities from the comfort of their homes.

Benefits of Using an IPO Investment App

Seamless User Experience

IPO Investment Apps have simplified the process of investing in IPOs by reducing complexities. They provide an easy-to-use interface where investors can browse through available IPOs, read the prospectus, and directly submit their bids. Gone are the days of dealing with paperwork and long waiting times. Everything can be handled with just a few taps on your phone.

Access to Real-Time Information

Staying updated on upcoming IPOs and market trends is essential for making informed decisions. An IPO Investment App offers real-time information about new IPOs, their subscription status, and any updates on allotment results. With this immediate access to critical information, you can act quickly and increase your chances of securing shares in high-demand IPOs.

Enhanced Investment Opportunities

An IPO Investment App not only gives you access to a wide range of IPOs but also enables you to make strategic decisions. With detailed company information, prospectuses, and subscription details at your fingertips, you can analyze and evaluate different IPOs more effectively. The app allows you to maximize your portfolio by investing in the right IPOs at the right time.

Faster Application Process

Traditional methods of applying for IPOs required you to fill out forms, visit bank branches, and wait for allotment results. With the IPO Investment App, the process is faster and more efficient. You can apply for IPOs directly through the app, making the process almost instantaneous. The app also allows you to monitor the status of your application, keeping you informed at every stage.

Increased Transparency

Transparency is one of the biggest concerns for retail investors in the IPO market. An IPO Investment App helps to address this by offering a clear and transparent process. You can easily access important details such as the price band, issue size, and financials of the company launching the IPO. Furthermore, allotment results are typically published on the app, allowing you to quickly verify whether your application has been successful.

Why Ipo India Are a Lucrative Investment Opportunity

India’s IPO market has experienced significant growth in recent years. Several factors contribute to the growing allure of Ipo India, including the country’s expanding middle class, a young population, and rapid technological advancements. Additionally, the government’s focus on improving business conditions and enhancing market liquidity has bolstered investor confidence.

Here are some reasons why Ipo India offer a lucrative investment opportunity:

Growing Economy and Market Potential

India’s economy has been one of the fastest-growing in the world, attracting investors both domestically and internationally. The Indian stock market has become an attractive destination for IPOs, with companies seeking to raise capital and expand their operations. Investing in Ipo India allows you to tap into this growth potential, as these companies often have significant upside potential.

Increased Number of IPOs

Over the past few years, the number of Ipo India has surged, offering investors a wealth of opportunities. This trend is expected to continue as more companies choose to go public to fund their expansion plans. IPO Investment Apps provide investors with access to these opportunities, ensuring they don’t miss out on high-potential investments.

Diverse Sectoral Exposure

Ipo India span a wide range of sectors, from technology and healthcare to finance and infrastructure. This diversity allows investors to build a well-rounded portfolio, with exposure to multiple industries. An IPO Investment App can help you track different IPOs across various sectors, giving you the flexibility to diversify your investments and reduce risk.

Favorable Regulatory Environment

India’s Securities and Exchange Board (SEBI) has implemented several regulations to protect investors and ensure the smooth functioning of the IPO market. These regulatory measures contribute to the overall stability and reliability of the IPO market, providing retail investors with more confidence in their investments.

How an IPO Investment App Maximizes Your Portfolio

An IPO Investment App enables you to take full advantage of the opportunities that Ipo India offer. Here’s how it can help maximize your portfolio:

Easy Diversification

With the ability to access IPOs across multiple sectors, an IPO Investment App allows you to diversify your portfolio efficiently. Diversification is key to reducing risk and increasing the potential for returns, as it spreads your investments across different industries and asset classes. This is particularly beneficial in a dynamic market like India, where various sectors are growing at different rates.

Timely Investment Decisions

The IPO Investment App provides you with real-time alerts, updates, and data about upcoming IPOs. This ensures that you can make timely investment decisions, buying into an IPO when the market conditions are most favorable. By getting in early, you increase your chances of benefitting from the post-IPO listing gains.

Consistent Monitoring and Management

Once you’ve invested in an IPO, the app allows you to track its performance. Whether it’s monitoring price movements, reviewing financial reports, or tracking company news, you can keep a close eye on your investments. This consistent monitoring enables you to make adjustments to your portfolio if necessary, ensuring that your investments are aligned with your financial goals.

Streamlined Portfolio Management

Some IPO Investment Apps offer portfolio management tools that allow you to consolidate your investments into one place. You can track your entire portfolio of stocks, including those in IPOs, helping you manage and optimize your investment strategy. The app can provide performance insights, helping you make data-driven decisions to maximize returns.

Conclusion:

Investing in Ipo India presents a wealth of opportunities for those looking to grow their portfolios. By using an IPO Investment App, you can access these opportunities quickly, efficiently, and transparently. The ease of use, real-time updates, and diverse investment options available through IPO Investment Apps empower investors to make informed decisions and maximize their returns.If you’re interested in growing your portfolio with Ipo India, an IPO Investment App is an essential tool. By making the process simpler and more transparent, it gives you the edge you need to capitalize on the dynamic IPO market and achieve your investment goals. Whether you are new to IPO investing or an experienced investor, these apps can help you maximize your portfolio and achieve greater financial success.